MATTHEW FORBES – MARCH 19TH, 2018

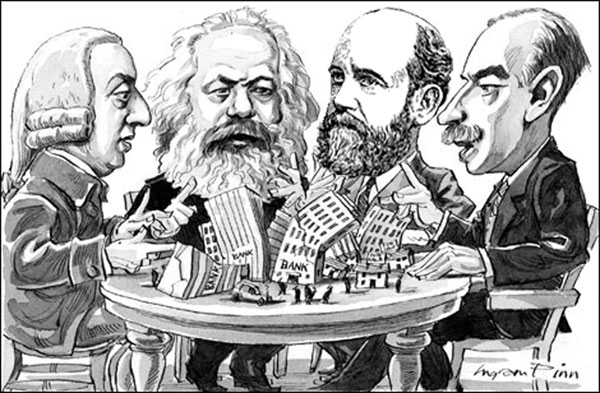

Economics is often thought of as a discipline of numbers. Quickly glance through any economics textbook and you will find scores of graphs and equations attempting to quantify everything and anything. But economic theories are only as good as the assumptions they are built upon, and creating accurate assumptions is an interdisciplinary art that touches upon psychology, philosophy, and politics.

For example, most economic models make the assumption that all parties involved are completely rational and self-interested. This is a pretty radical assumption to make. Most people struggle to multiply by numbers larger than 10 without the aid of a calculator, much less calculate their expected benefit from buying life insurance or investing in another year of education. The billions of dollars donated to charity every year seem to contradict this notion of people being purely self-interested. Some might say that donors are concerned with the prestige of donating or potential tax benefits, but the potential for a pure altruist motive should be considered as well.

Past economic models erroneously exclude altruism or other psychological motivations as factors in their core assumptions about consumer behavior; therefore, cutting-edge research in the field of behavioral economics attempts to correct these errors and the models they support by incorporating elements of human psychology into economic theories. In fact, behavioral economics is becoming such an influential field that University of Chicago professor Richard Thaler, the “father of behavioral economics,” recently won a Nobel Prize for his life’s work on the subject. By gaining more insight into how humans truly act, economic models can better predict how markets will act.

Economics also involves asking philosophical questions about value and fairness. It is often assumed in economics that efficiency is king, regardless of who is gaining or losing from potential gains in efficiency. The U.S. Department of Transportation, for example, defines “economically efficient” to be “when resources are allocated to their highest valued use in the economy.” But what does it mean to be “highest valued”? Is it truly better to grow the size of the economy if all these gains are going to only a small section of the populace? Economists also often must ask who should pay for certain costs, such as what countries should pay to reduce greenhouse gases. Should those with the most resources be the ones to pay, or those who stand the most to benefit, or those who are responsible for the problem in the first place? These are all questions that have no definitive answer and need more complex models to accurately resolve.

Many economic models also carry heavy political implications. Models asserting that a certain government intervention will increase general welfare assume the government can make this intervention flawlessly. They do not account for the real risk that government mismanagement of a proposed solution may prove worse than the problem attempting to be solved. For example, governments will often inject a fiscal stimulus into the economy to boost GDP in the event of a recession; however, it is possible that this fiscal stimulus may be too large and result in an overheating of the economy over its maximum potential output, leading to higher rates of inflation. This was the case in the late 1960s and 1970s when the U.S. government pursued higher and higher rates of economic output well beyond economy’s potential, contributing to the “Great Inflation” that characterized much of the decade.

Additionally, many economists, such as Frederick Hayek, argue that such governmental management of the economy would constrain individual freedoms and put society on “the road to serfdom.” For these economists, any central planning of the economy necessarily involves placing power into the hands of a select few individuals, who can then use this power for other malevolent goals. The solution, they argue, is to trust the free market instead, even if it sometimes fails to correct inefficiencies such as externalities or prolonged recessions. Implicit within many economic models are underlying assumptions about the appropriate role and size of government, which are constantly in debate.

Economists like to think of themselves as uncovering absolute truths about how the world should be run. But it is to the detriment of the academic field to ignore the subjective foundations upon which all of economics is built. Instead, these foundations should be routinely dug up and reexamined so that they may be refined and strengthened.

Featured Image Source: Georgist Journal

Disclaimer: The views published in this journal are those of the individual authors or speakers and do not necessarily reflect the position or policy of The Berkeley Economic Review staff, the Undergraduate Economics Association, the UC Berkeley Economics Department and faculty, or the University of California at Berkeley in general.