THOMAS SO – OCTOBER 29TH, 2019 EDITOR: LUCIA DARDIS

The U.S. manufacturing sector is in recession. Stock prices went down Tuesday, Oct 1st as the Dow Jones fell about 350 points after the Institute for Supply Management (ISM) announced a further drop in manufacturing index (Purchasing Manager’s Index), which has declined from 49.1% in August to 47.8% in September. To give a better context of these numbers, any figure less than 50% indicates a shrinkage in the US manufacturing sector, with this August marking the first time the sector has contracted in three years. According to the Manufacturing ISM “Report on Business,” the export orders index fell by 2.3% to 41%, which is the lowest level ever since March 2009. The employment index also dropped by 1.1% to 46.3%, which was the lowest point since January 2016—marking the second month that this sector has been shrinking after three years. To explain the trend, the report mentioned that business confidence continues to decrease as global trade issues significantly impact new orders and consumption.

Most sources point towards the ongoing trade wars launched by the Trump Administration. China, which accounts for up to 15% of US total exports this August, retaliated by imposing tariffs on U.S. goods specifically targeted at the industrial Midwest and the farm belt. For example, Northeast Hardwoods, a hardwood lumber mill, suffered a 43% sales loss to the Chinese market within a year. As a result, the company had to halt investments, close down individual mills, and lay off up to 70 employees. All in all, a decrease in lumber exports have decreased the lumber industry’s revenue by $615 million. The effects of the tariff also trickle down to other manufacturers. For example, when Caterpillar Inc. scaled back its production of tractors and construction trucks due to the decreasing sales in China, manufacturers providing ancillary parts, such as fasteners and locknuts, were also forced to decrease production. The sector is now considered to be in a recession.

This could potentially have significant economic and political impacts on the US. The manufacturing sector currently accounts for 11% of the total output of the United States and up to 10% of total private employment. Although this is a relatively small portion, there are concerns whether such effects could spill over and affect consumption, which makes up 70% of the total economic output. This concern was cited by a warning issued by JP Morgan as the slump in manufacturing, along with uncertainties in the trade war, has caused businesses to pull back on spending—which ultimately impacts consumers in the economy. Moreover, consumer spending is highly dependent on the labor environment, which is currently supported by low unemployment rates. The shrinking manufacturing sector could change this trend. In states like Indiana, it is predicted that employment will go down as shipments of recreational vehicles fall down by 20% in Northern Indiana. Considering the entire U.S. as a whole, the Bureau of Labor Statistics reported that there was a net loss of 2000 manufacturing jobs this September. Decreasing orders and output causes manufacturers to scale down production and even lay off workers in order to cut costs, which can impact household income and discourage consumer spending.

An underperforming economy could stir political discontent. President Trump, already facing an impeachment battle, advocated for protecting US firms via tariffs against this “unfair” trade. That may have won him the election in 2016, but a recession in the industry could cause that strategy to backfire for the upcoming election in 2020. Moody’s Analytics chief economist, Mark Zandi, pointed out that job losses are mounting up in states that won President Trump the election, such as Michigan, Pennsylvania, and Wisconsin. Meanwhile, Minnesota, a state which Trump would like to regain from his narrow loss in the previous election, faced about $1 billion in tariffs (since February 2018) as a result of Trump’s trade war with China. This may not seem like a big amount, but it could hurt Trump’s supporter base for the upcoming election. In the midst of pessimism over recent trade negotiations with China, Trump is in a disadvantaged position, facing an urgent need to secure consumers’ and businesses’ support in order to pave the way for his presidential re-election campaign.

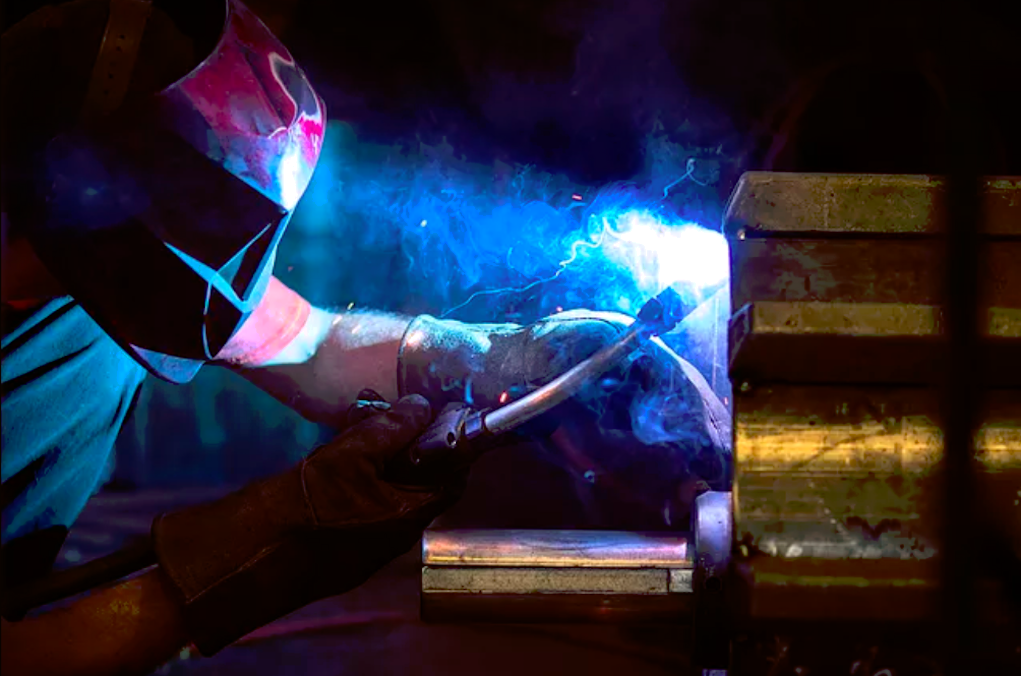

Featured Image Source: DROP Sprockets

Disclaimer: The views published in this journal are those of the individual authors or speakers and do not necessarily reflect the position or policy of Berkeley Economic Review staff, the Undergraduate Economics Association, the UC Berkeley Economics Department and faculty, or the University of California, Berkeley in general.