DAVIS KEDROSKY – APRIL 29th, 2020

EDITOR: SEAN O’CONNELL

The England of legend is a land of forests. From Arthurian knights venturing through primeval groves to Robin Hood’s Sherwood raids, woodland—as a font of evil, mystery, and natural power—is an inescapable motif of the island’s mythology. Popular imagination supposes that before the Industrial Revolution sent satanic mills sprawling across the countryside, England was a bucolic idyll, every interstice filled by profusions of oaks and chestnut. Yet over two centuries before Blake and Wordsworth mourned the demise of pastoral life, Englishmen were already facing the imminent destruction of their forests. By the mid-sixteenth century, the Isles, increasingly cleared of woodland, were immersed in the first great energy crisis of the modern era, one that would alter the trajectory of the global economy.

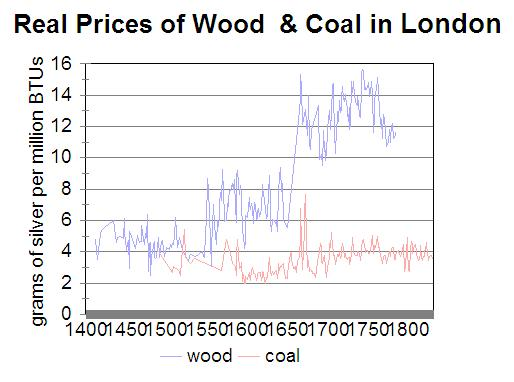

Medieval England was not well-forested by European standards. Much native woodland had been cleared during the Bronze Age, and four hundred years of Roman occupation, followed by Anglo-Saxon and Scandinavian settlement, would take their toll as well. Only 15% of available land was tree-covered in 1086, a percentage that steadily declined as the population expanded over the following three centuries. The Black Plague provided a brief reprieve from English axes but, by 1500, the population had recovered to pre-pandemic levels (4.4 million) and the cutting had resumed. Indeed, deforestation advanced even more swiftly in subsequent years as potential uses for wood multiplied, from ship-building and residential construction to smelting and glass-blowing. By the 1620s, England was importing vast quantities of timber from Scandinavia and, later, from the American colonies in order to maintain its fleet in incessant conflicts with the Dutch and French. With both population and per capita wood consumption rising amid a commercial boom and available supply dwindling (as land was diverted to habitation, commerce, and agriculture), the price of firewood rose tenfold between 1500 and 1700. Wood prices doubled compared to a general price index (estimated from a basket of similar goods), increasing more than any other key commodity during a period of pronounced inflation.

Historian John U. Nef famously labeled this episode a “timber crisis,” wherein demand for wood as fuel and construction material introduced untenable costs in many sectors. “Between the accession of Elizabeth and the [English] Civil War,” Nef wrote, “England, Wales, and Scotland faced an acute shortage of wood, which was common to most parts of the island rather than limited to specific areas, and which we may describe as a national crisis.” The consequence, as he laid out in his 1932 The Rise of the British Coal Industry, was a nationwide energy transition on an unprecedented scale. With wood prices “soaring,” the English renewed experiments with burning comparatively cheaper coal for both industrial endeavors and residential heating, especially in the populous south. Coal shipments out of eastern ports such as Newcastle increased twentyfold between 1550 and 1700, and mining increased on a scale comparable to that of the early 19th century. As industries adopted the new fuel source, which was once scorned for its noxious fumes and poor smelting properties, they produced a swathe of crucial innovations that increased coal’s compatibility with a wider range of tasks. From coking to the steam engine, these novelties led Nef to conclude that “the technological advances of the Industrial Revolution were largely the culmination of the innovative period associated with the conversion to coal.” From the energy crisis had come an economic transformation.

Image Source: Voxeu

The sheer ambition of the “timber crisis” theory sparked a series of challenges among economic and environmental historians. Michael Flinn and George Hammersley sought to compartmentalize Nef’s data during the 1950s, contending that his London-only time series belied extreme variation in English markets, and that forests were abundant (economically speaking) throughout the remainder of the country. Firsthand accounts, however, support Nef’s original data. Parliament repeatedly moved to limit industrial wood consumption during the late sixteenth century, even launching an investigation into suspected fuel waste at Sussex foundries. In 1580, William Harrison wrote that one could ride for twenty miles and only see trees “where the inhabitants have planted a few… about their dwellings.” Thirty years later, Edmund Howes issued a gloomy declaration eerily redolent of present resource anxieties: “the great expense of timber for navigation, with infinite increase of building of houses… besides the extreme waste of wood in making iron, burning of brick and tile, that at this present, through the great consuming of wood as aforesaid, and the neglect of planting of woods, there is so great a scarcity of wood through the whole kingdom.”

Industrial historian Robert Allen, in a 2003 survey, challenged claims that shortages throughout Europe and England had fomented the timber crisis, but did allow that the colossal London market may have driven the energy transition. He strengthened this claim in his seminal work The Industrial Revolution in Global Perspective. With London’s population swelling to over half a million and urban wages rising in a newly-commercialized economy, English demand for wood in 1700 was geographically concentrated. At the same time, sources of timber supply were necessarily dispersed—plots regrew slowly, and riverine shipping (cheaper than land transport) was inaccessible for large swathes of the country. Allen noted that London’s resource “bottleneck” saw rises in both the supply of and demand for timber, and the resulting price surge helped to create a 50% relative discount for coal—a gap needed to induce commercial and residential. This in turn, among other factors, stimulated the creation of energy-intensive, coal-powered machinery that would drive industrialization in textiles, metallurgy, and power technology and propel England to global economic supremacy.

Energy transitions have repeatedly rocked human history, from oil and peat to hydroelectricity and nuclear fusion. At present, a dilemma opposite to England’s timber crisis appears most pressing: not an inevitable turn from an increasingly scarce baseline source (wood) to a relatively costly alternative (coal), but from a persistently inexpensive baseline (fossil fuels) to a slowly cheapening alternative (renewables, alongside cleaner natural gas). The dynamics of the transformation, however, are strikingly similar to those of the eighteenth and nineteenth centuries.

As industry observers have argued, the achievement of lower renewable price levels relative to fossil fuels enables greater private investment in solar and wind generation. Once these sources are installed, the process Allen described for Britain can ensue, wherein economies of scale, learning-by-doing, and corporate research decrease costs such that market incentives make renewable adoption an economic necessity. Experts differ on the speed at which this can occur, but it is undoubtedly occurring. Financial markets, utilities companies, and national governments alike are divesting from coal as solar installments promise increasing profitability. Even the agonizingly slow pace of decarbonization is not itself cause for pessimism; in 1900, for example, long-obsolete biofuels still supplied half of global energy output. Energy transitions are by nature slow, but modern information flows and deliberate private and public interventions have already made the present iteration swift by historical standards.

Environmental degradation is a surprisingly neglected consequence of economic growth. Enormous social costs and resource bottlenecks will surely ensue—not least in the form of increased energy demand—as the developing world increases incomes and consumption habits. Yet the English timber crisis demonstrates that these apparent disasters can be unparalleled opportunities for innovation and structural transformation. The OPEC-induced oil crises of the 1970s, which drove a global retreat from crude consumption, bore such consequences. When popular and political will are lacking, market prices can constitute an inexorable force for improvement. As in England, financial incentives are ensuring that long-term pressure is toward a clean-energy transition, and that any additional impetus will only accelerate an already-hastened process. How far countries can exceed that minimum depends wholly upon their response.

Featured Image Source: EH-Resources

Disclaimer: The views published in this journal are those of the individual authors or speakers and do not necessarily reflect the position or policy of Berkeley Economic Review staff, the Undergraduate Economics Association, the UC Berkeley Economics Department and faculty, or the University of California, Berkeley in general.