ALKIS TOUTZIARIDIS – NOVEMBER 7TH, 2023

EDITOR: LARA RAMIREZ

The health of the housing market, often regarded as the pulse of the economy, is a pivotal component in shaping the financial and sociopolitical landscape. As the cornerstone of the American dream, roughly 65% of housing units are owner-occupied, making them a significant wealth source and a powerhouse of employment with over a million workers. Moreover, the importance of the housing sector extends to more than numbers and statistics. It is the bedrock of sustenance and security, being a fundamental need and the primary wealth vessel in most countries. For instance, in the U.S., it accounts for around a third of the total assets held by the non-financial private sector. In France, while fewer than a quarter of households invest in stocks, more than 65% invest in real estate. The significance of this sector is further highlighted by the fact that its implications ripple across multiple sectors of the economy. For instance, it is essential in monetary policy transmission and plays a facilitative role in labor mobility. In recent years, research has been underscoring the gravity of labor mobility in efficient resource allocation, fostering trade competitiveness (and resistance to trade shocks), and driving optimal human capital distribution, all of which a healthy housing sector can provide.

It is essentially a double edged sword which can either lead to growth and prosperity or catastrophic economic damage, as exemplified by the 2008-09 financial crisis. Especially since it has been often overlooked in economics textbooks, analyzing the current state of the housing market is of utmost importance. In fact, during the past few decades, out of nearly 50 systemic banking crises, over two-thirds were preceded by boom-bust patterns in house prices. The main focus of this article will be answering if a housing crash is expected and the policies that are currently being implemented to tackle the issues California is facing.

The examination of this topic provided in this article requires a multifaceted approach. The International Monetary Fund (IMF), a global organization focused on monetary cooperation and financial stability, recommends that these main factors should be considered: long-run valuation ratios (house prices to rents and incomes), credit growth, lender characteristics, housing supply constraints, household indebtedness, and the financial methods employed by buyers. The typical “menu” for policymakers can be divided into: microprudential policies (focus on individual financial institutions’ resilience) and macroprudential policies (target system-wide risks with tools like loan-to-value and debt-to-income ratio limits and sectoral capital requirements).

All these broad approaches are, of course, in combination with monetary policy strategies. The current situation with interest rates is that during the September 2023 meeting, the Federal Reserve maintained the target range for the federal funds rate at a 22-year high of between 5.2% and 5.5% following the July hike, expecting at least one more rate hike in 2023. Hence, as per NBC News, a major American television network, 30-year mortgage rates reached the highest in over two decades, surpassing 7%. Despite these high mortgage rates, in contrast with what the standard economic theory would predict, housing values are on the rise again due to a supply-demand imbalance. In addition, the issue is exacerbated because homeowners are now hesitant to sell. The supply crunch is driving prices up, and many already have low mortgage rates that were secured years ago when interest rates were at historically low levels. Leading economists do indeed predict that the hawkish approach by the Fed and the hikes will eventually stabilize housing prices, but a decrease is unlikely in the future.

The main focus of this article will be on answering whether a housing crash is expected and which policies that are currently being implemented to tackle the issues California is facing. For the current situation, the most relevant measures concern affordability-focused strategies. The intricate relationship between rising demand and stringent long-term supply constraints create a lot of tension amongst economists on which tools to use and how not to risk a potential collapse of the housing market. These policies range from rent control, social or public housing, mortgage subsidies, housing vouchers, to inclusionary zoning.

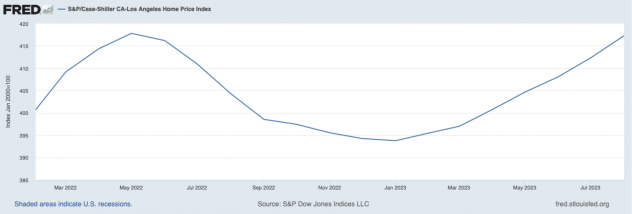

Housing prices have increased for the sixth consecutive month in September 2023 with the S&P CoreLogic’s Case-Shiller U.S. National Home Price NSA Index showing that the decline that started in July 2023 has been fully compensated by subsequent increases.

Source: S&P Dow Jones Indices LLC

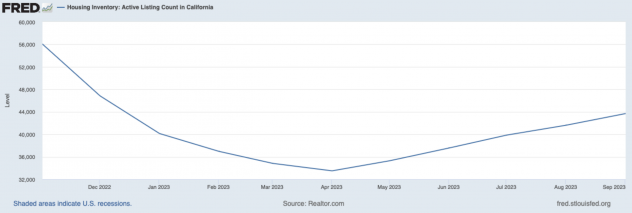

As Mar Hamrick states, the rise in mortgage rates “is acting as a kind of golden handcuffs.” To elaborate, the rising property prices are lucrative for homeowners, yet they are less inclined or “handcuffed” from selling them since the higher mortgage rates have made it more expensive to buy a new home. Given that sales dropped by 0.7% from July to August 2023, a 15.3% decline year-over-year, it is evident that we are referring to primarily supply-side issues.

Source: Realtor.com

The expert opinions on why a housing crisis is not expected in the near future is that inventories are still low and builders haven’t overproduced, eliminating the risk of a housing surplus. Demand is also keeping up, influenced by factors like millennial purchasing patterns. To put this claim into perspective, homes in California stayed on the market for a median of 27 days (Aug. 2023), which is 5 days less than the same time last year. Furthermore, lending standards remain as stringent as ever and foreclosure activity is low compared to post-2007 levels with half of the mortgage-owned properties being equity-rich in the second quarter of 2023. Consequently, a relatively strong job market and the overall strength of the economy are significant reasons why a housing crash is not expected.

Policies Implemented

Despite previous efforts to increase housing production, the statistics demonstrate that it has been below expectations. Hence, California’s 2023 legislative session primarily focused on tackling this exact issue and removing barriers to boost housing results.

A significant bill proposed is AB 1633, which ensures that local jurisdictions are not using the CEQA (California Environmental Quality Act) to delay housing projects compliant with zoning. To elaborate, it expands the Housing Accountability Act’s definition of “disapprove the housing development project” to include delays or inaction in CEQA reviews. After this bill is passed, jurisdictions will have 90 days to decide on the CEQA and penalties for violating the AB 1633 will be strictly enforced. Another policy concerning the CEQA is AB 1307, signed into law on September 7. It was a response to a court ruling that required noise generated by residents of housing to be considered under CEQA, so from now on, this will not be considered a significant environmental impact. The benefits can be especially impactful for U.C. housing at People’s Park and can help streamline housing development for various educational institutions.

Other relevant policies to the article concerned streamlining development and post-entitlement permitting, notably by expanding SB 35’s reach and addressing permit appeals in San Francisco. Lastly, a note-worthy bill passed is AB 821 which addresses inconsistencies between zoning ordinances and general plans. To elaborate, if a development application aligns with the general plan, jurisdictions must make the zoning ordinance consistent within 180 days or process the application based on the general plan. Legal remedies are provided to enforce compliance, ensuring general plan-compliant projects move forward without delay.

What needs to be noted for these policies however, is that deregulation is not a panacea for all housing related problems. This approach has its costs too because it means that some environmental effects could be overlooked; and, in an attempt to close CEQA loopholes, regulators could create long-term costs from the environmental degradation or other negative externalities. Still, these steps don’t seem to create too many issues, and it is expected that they will have a notable impact on increasing the housing supply and, eventually, making housing more affordable.

Overall, a housing crash is not expected by most economists, as the current features of the housing market differ substantially from the ones before the 2008-09 crash. The increased interest rates have added another element to this complex equation, hinting at a potential stabilization of prices in the future. In light of the fact that a shortage of housing is the primary factor increasing prices, the challenges posed by the intersection of housing needs and regulations necessitate further legislative adjustments to ensure an equilibrium between more affordable housing and sustainable development. The 2023 California Legislative Session has demonstrated a focused effort to address the state’s ongoing housing crisis and a positive note on what is to come in the future.

Featured Image Source: Digitally created by Alkis Toutziaridis with the assistance of DALL·E 2.

Disclaimer: The views published in this journal are those of the individual authors or speakers and do not necessarily reflect the position or policy of Berkeley Economic Review staff, the Undergraduate Economics Association, the UC Berkeley Economics Department and faculty, or the University of California, Berkeley in general.